Tariffs, Turnarounds, and Tuesday’s Top Movers

Stock futures edged slightly higher on Tuesday morning as investors digested President Trump’s latest trade manoeuvre—new tariffs on 14 countries—while extending the deadline for his “reciprocal” tariff policy to August 1. The move adds uncertainty to the global trade landscape, but markets held steady as attention shifted to notable company-specific developments.

📈 Biggest Gainers

Wolfspeed (WOLF) +17%

Wolfspeed shares surged again after Monday’s jaw-dropping 96% rally, fuelled by the announcement that Gregor van Issum—formerly of ams-OSRAM and NXP—will take over as CFO from September 1. The leadership shakeup, alongside the recent appointment of COO David Emerson, signals a serious push to turn around the chipmaker’s profitability and expand its footprint in silicon carbide technology, critical for EVs and AI data centres.

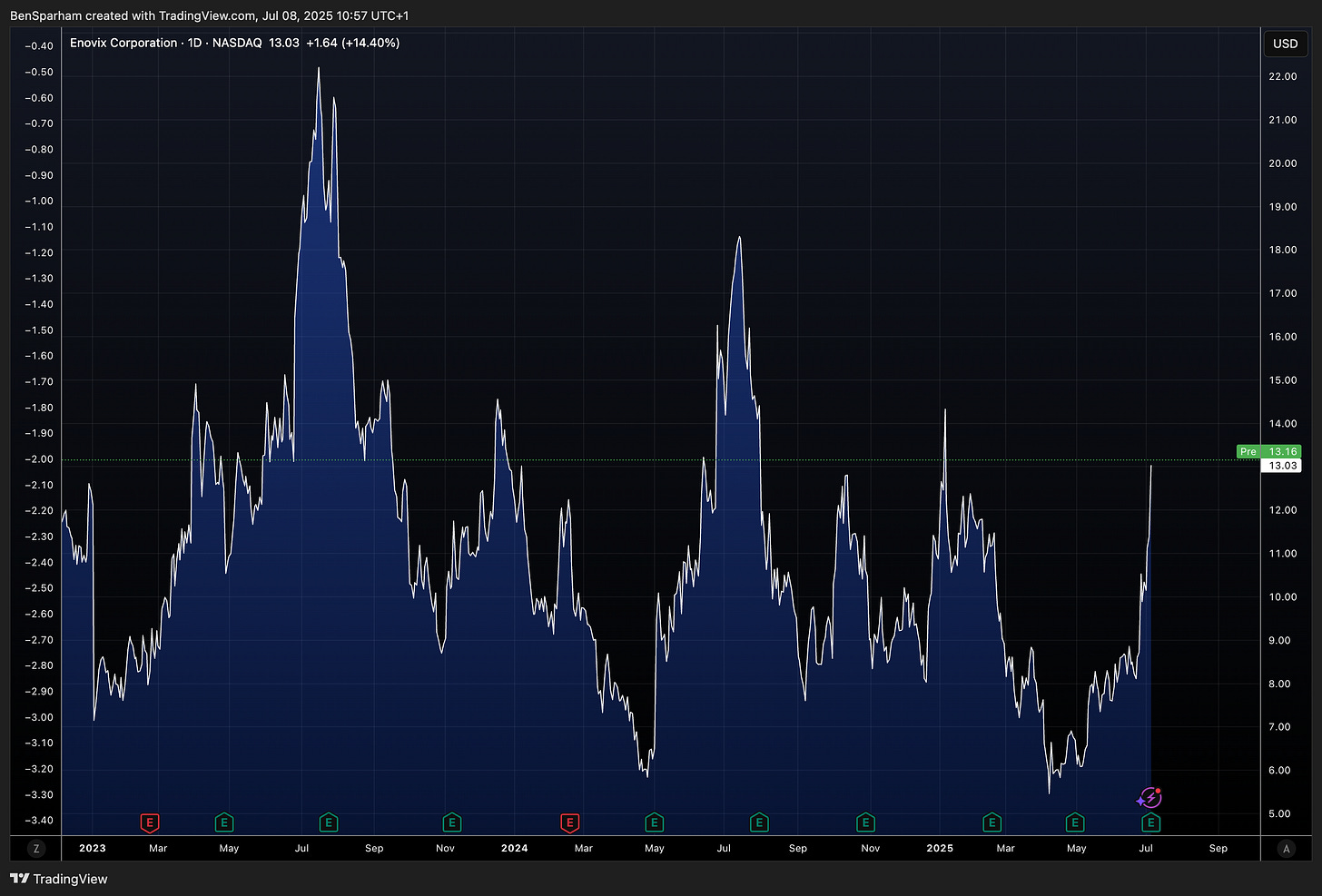

Enovix (ENVX) +2%

Battery innovator Enovix built on Monday’s 14% jump, marking its highest share price since January. The company raised Q2 guidance, forecasting a smaller-than-expected loss and $7.5M in revenue, ahead of analyst expectations. A bullish $60M buyback plan, five straight quarters of guidance beats, and the launch of its AI-1 battery for next-gen AI smartphones boosted investor confidence. Northland reaffirmed its Outperform rating with a $25 price target.

📉 Biggest Loser

Ciena (CIEN) -4%

Ciena fell after Morgan Stanley downgraded the stock to Underweight from Equal-weight, citing limited margin growth and constrained earnings potential in the near term. Analyst Meta Marshall prefers Coherent over Lumentum in the optical space and sees more promising upside in Corning. The firm set a $70 price target for Ciena, suggesting a 13% downside from the previous close.

With political tensions rising and corporate shakeups taking centre stage, investors are balancing macro headlines with company-specific catalysts. As earnings season picks up, expect more volatility and opportunity in the days ahead.