📈 Futures Jump as Inflation Data Lands Mostly In-Line

U.S. stock index futures ticked higher on Tuesday morning after the July inflation report came in largely as expected, though core inflation showed a slightly hotter annual reading.

By 8:30 a.m. ET, S&P 500 futures were up 0.6%, matching gains in the Nasdaq 100 and Dow Jones Industrial Average futures. The bond market was calm, with the 10-year Treasury yield steady at 4.28% and the 2-year yield unchanged at 3.79%.

July Consumer Price Index (CPI) rose 0.2% month-over-month, perfectly in line with expectations, and slowed from 0.3% in June. Year-over-year, inflation was 2.7%, matching last month but slightly below the 2.8% consensus forecast.

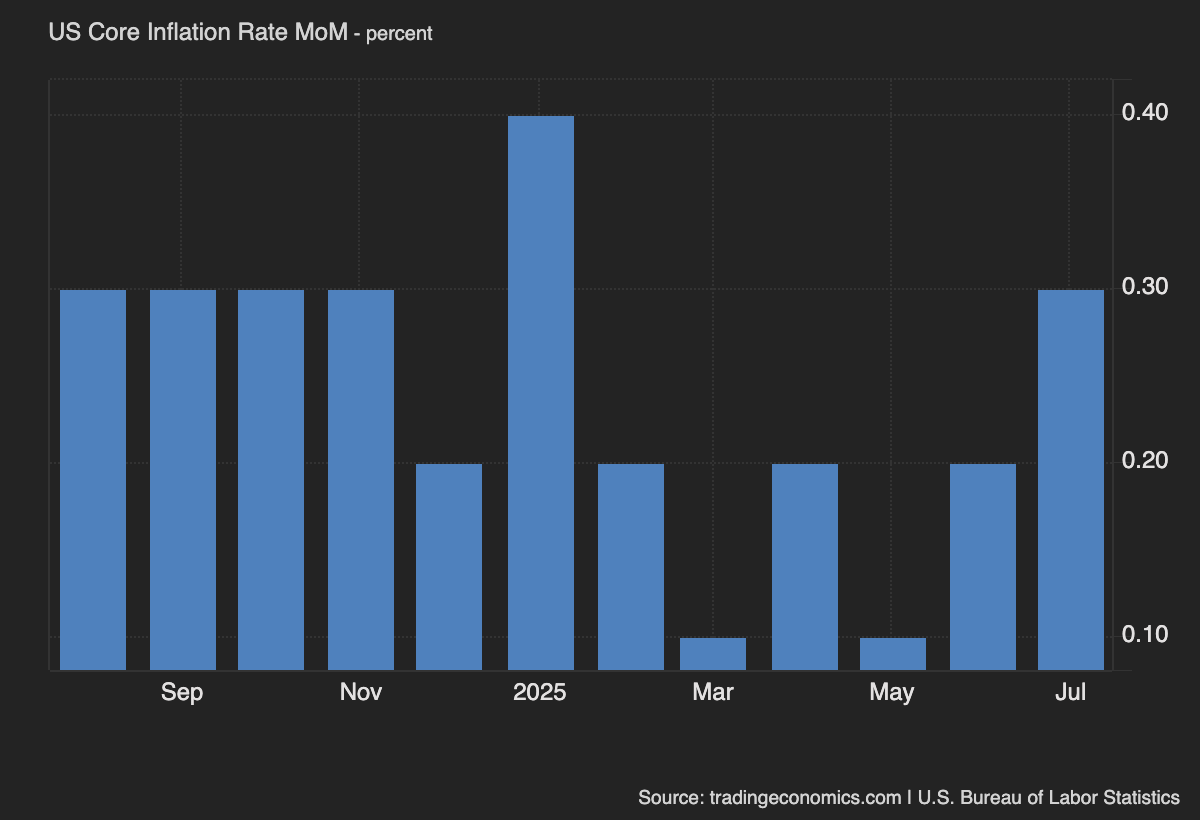

However, Core CPI—which strips out volatile food and energy prices—rose 0.3% M/M, matching estimates but accelerating from June’s 0.2%. On a yearly basis, it increased 3.1%, just above the 3.0% expected and higher than 2.9% in June.

The numbers offered a mixed picture for markets: headline inflation remains tame, but underlying price pressures are proving a bit stickier.

Wall Street’s major averages closed lower on Monday, weighed down by caution ahead of the CPI release. A brief boost from big tech headlines wasn’t enough to hold gains, and stocks reversed into the red by the close.

Deutsche Bank’s Jim Reid noted that “markets have been relatively subdued over the last 24 hours, as investors await today’s CPI print and the much-anticipated Trump-Putin summit on Friday.” He added that one uncertainty is off the table for now, as President Trump extended the U.S.-China trade truce for another 90 days.

With the inflation data now in, the economic calendar lightens up. Apart from the CPI, the only notable item on tap is the Treasury Statement later today.