Apple Downgraded 🔻

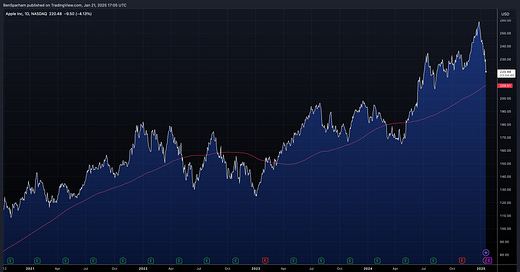

Apple had a rough day as its stock fell about 5% on Tuesday, moving closer to its 200-day moving average of $217.02.

The decline came after two major downgrades—Jefferies shifted its rating to Underperform from Hold, and Loop Capital dropped its rating to Hold from Buy with a $230 price target.

Jefferies analysts, led by Edison Lee, lowered their price t…

Keep reading with a 7-day free trial

Subscribe to Ben Sparham to keep reading this post and get 7 days of free access to the full post archives.